Business Insurance in and around Lubbock

One of Lubbock’s top choices for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

Preparation is key for when a catastrophe happens on your business's property like an employee getting injured.

One of Lubbock’s top choices for small business insurance.

Insure your business, intentionally

Customizable Coverage For Your Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or errors and omissions liability, that can be molded to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Rebecca Egert can also help you file your claim.

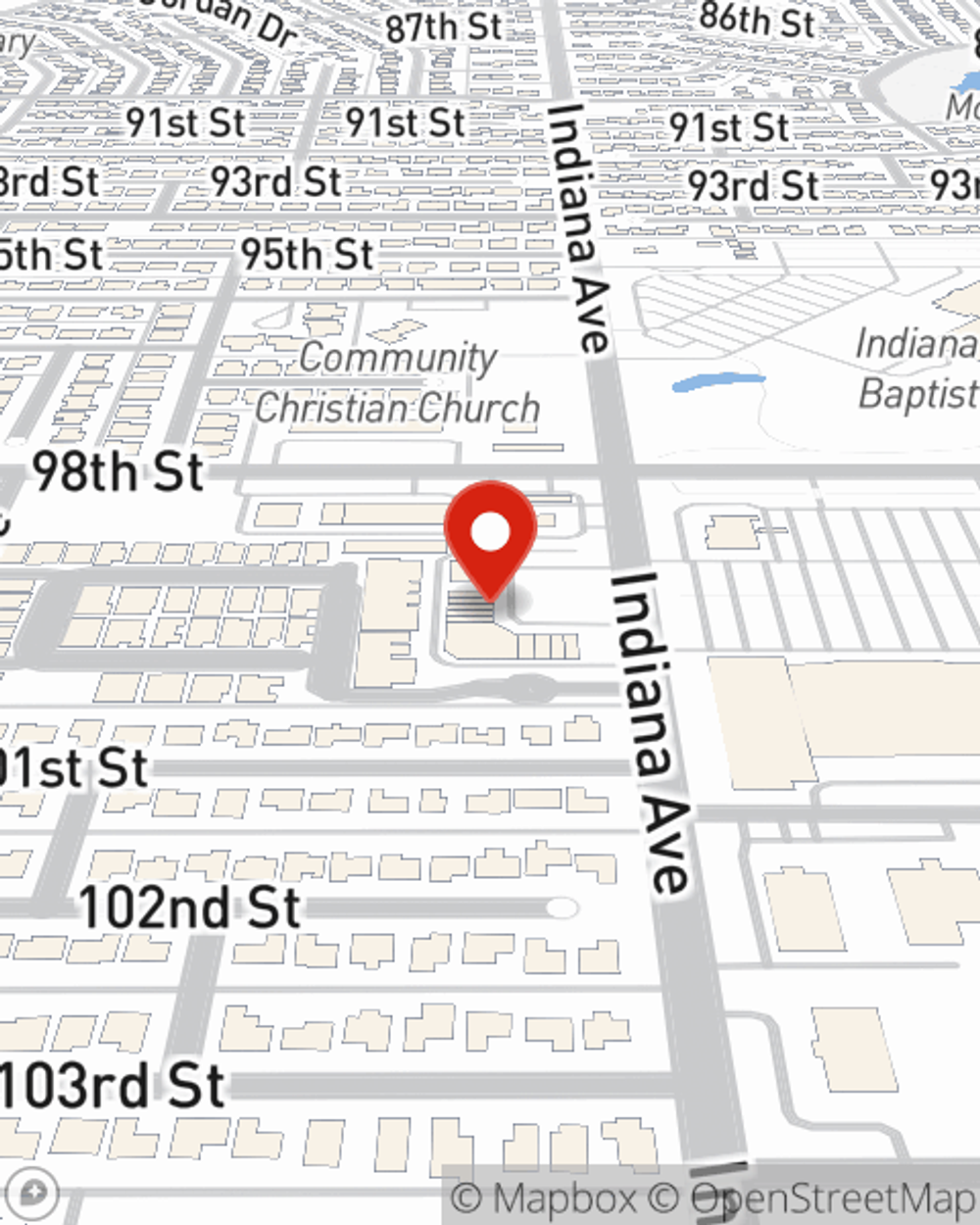

Eager to identify the specific options that may be right for you and your small business? Simply get in touch with State Farm agent Rebecca Egert today!

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Rebecca Egert

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.